Considerations for Choosing the Business Structure That is Right for You

Over half a million new small businesses are founded each year in the United States. Owning your own business comes with its own unique advantages and, lets face it, it is part of the American Dream.

Small Business owners are afforded many perks of being self-employed. Being in control of your own destiny and managing the perfect work/life balance are among the top reasons people go into business. To quote Marc Anthony, “If you do what you love, you will never work a day in your life.”

Being a small business owner has its risks but also has its rewards. After your small business idea comes to fruition, the next most important consideration is how to structure your business and protect yourself. This is where things can get confusing. It is always wise to consult with an attorney and and/or an accountant to determine how to best safeguard what you have worked so hard for.

Careful consideration is of the utmost importance to make sure you understand all of the tax ramifications associated with how your business is structured. As you know, tax laws frequently change so what may have been true in the past may be different by the time to are ready to get started. Protecting your business from liability, profits and personal property should not be left to chance. Other important considerations include how your business will be managed and what your long-term goals are.

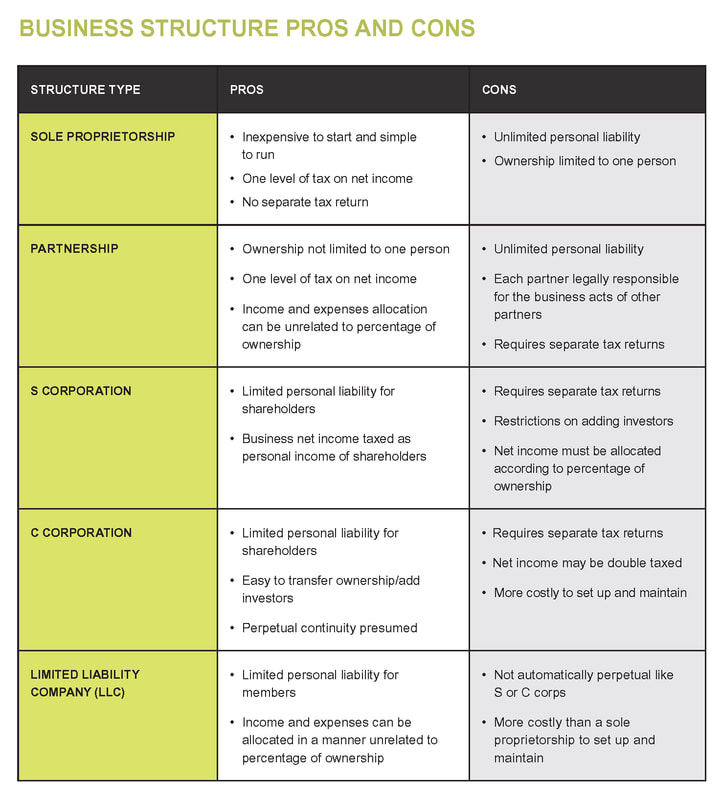

There are several ways to structure your small business. On the left is a chart with the basic pros and cons of each type. An attorney can explain each structure type in further detail and help you with assessing what he/she thinks is in your best interest. Consulting with an attorney can be an important investment in your business.

Although it is possible to convert/restructure your small business after you have opened it, it is always best to do your due diligence prior. By doing so, you can save yourself a lot of time and money.